Payroll Tax Updates

Throughout the year, Sage releases Payroll tax updates. When a tax update is available, you will see a message when you access a task in the Payroll module. If you have the appropriate security setup, you can click Yes to download the tax update, and you'll then be asked if you want to install it. The updates can also be installed using the Payroll Tax Update utility on the Payroll Utilities menu. If you don't download the update, the message will appear again as a reminder the next time that you access a Payroll task on a later day.

Why updates are needed

The Sage Payroll Tax Calculation Engine (or Payroll Engine for short) is a service hosted in the cloud, along with the Sage Payroll compliance data, that incorporates the tax rates, limits, and tax calculation rules for the United States. This service takes input from Sage 100 and calculates payroll taxes. The input has no personally identifiable information and contains everything the Payroll Engine needs to calculate taxes for the current pay run. The information provided to the Payroll Engine, referred to as a payload, is mostly a series of codes and numbers used to identify which taxes to calculate, employees' filing statuses and number of dependents, the date for the pay cycle, earnings and deductions along with their types, and the pay amounts for the current pay run, and year-to-date totals.

Sage 100 communicates with the Payroll Engine using a series of cross-reference codes contained in system tables that are installed as part of the Payroll module. These tables are used throughout the module to match codes used in the Payroll Engine with the more user-friendly Sage 100 counterparts. For example, you will see these codes used in Earnings Code Maintenance when selecting a tax rule to associate with the earnings.

These codes are used when calculating payroll and are sent to the Payroll Engine. There are also cross-reference codes used behind the scenes to identify filing statuses, tax codes, tax groups for states and local jurisdictions, tax locations, and more. All of these tables are used to put together the payload that is sent to the Payroll Engine when running Payroll Tax Calculation.

Periodically, there are updates to these tables, which is where the Payroll Tax Update utility in Sage 100 comes in. Sage 100 communicates with the payroll service in the cloud to see if any of these references have changed. For example, if a state has a new filing status or a county has a new tax. If there is a change, you see the message asking if you want to download the update.

Installing an update

When you install a payroll tax update, you are essentially updating the cross-reference system tables with the latest changes from the cloud payroll service. This keeps your payroll system up to date with the ability to properly communicate with the Payroll Engine. For more information, see Payroll Tax Update in the Sage 100 help.

Below is a list of tables that are updated when you run the Payroll Tax Update utility.

| Table | Usage | Areas Used |

|---|---|---|

| PR_TaxCompensationTaxRule | Cross-reference for earnings types. | Earnings Code Maintenance and Payroll Tax Calculation |

| PR_TaxDeductionTaxRule | Cross-reference for deduction types. | Deduction Code Maintenance and Payroll Tax Calculation |

| PR_TaxFilingStatus | Cross-reference by tax group of employee filing statuses. | Employee Maintenance and Payroll Tax Calculation |

| PR_TaxGroup, PR_TaxGroupDetail | Relationship of state and local tax groups with their corresponding tax codes. | Tax Profile Maintenance, Company Tax Group Maintenance, Employee Maintenance, and Payroll Tax Calculation |

| PR_TaxLocation, PR_TaxLocationDetail | Relationship of tax locations and which tax groups belong to a location. For example, tax Location CA-SANCO-SANCT consists of 3 tax groups: Federal, California, and San Francisco. | Tax Profile Maintenance, Employee Maintenance, and Payroll Tax Calculation |

| PR_TaxCodeProperty, PR_TaxProperty | Maintains which properties need to be set for certain taxes. For example, some taxes have limits; therefore, YTD information is needed. Some taxes require the filing status. | Payroll Tax Calculation |

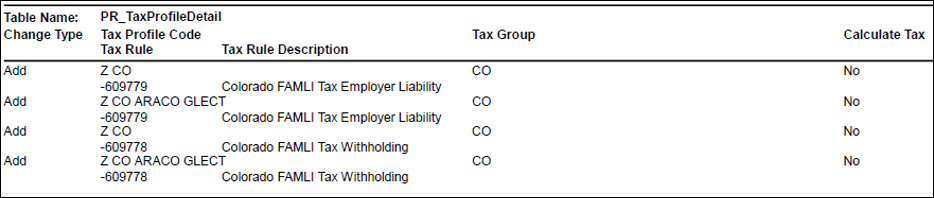

| PR_TaxProfileDetail | Indicates if a tax was added or removed to an existing Tax Profile(s). | Tax Profile Maintenance |

| PR_TaxRateHistory | Partial list of tax rates and limits. | Quarterly Tax Report and Federal and State Tax Reporting for reference. |

After installing the update

After installing the update, you should complete the following steps:

- Run the Payroll Tax Update Report, which is located on the Payroll Utilities menu. This report shows the differences in the cross-reference data. This report shows the Payroll cross-reference codes that are used in the formation of the payload that is sent to the payroll service.

This report does not tell you if your state or federal withholding rates have changed, but it will tell you if there was a new tax added or if a new deduction type was added. This report can give you some indication of whether there were any changes that could be applicable to your employees.

In the PR_TaxProfileDetail section, the report will tell you if a new tax was added to any of your existing Tax Profiles. In the following sample, the Change Type is Add and the Calculate Tax is No. The update does not know if this tax is applicable to your business. If the tax is applicable to your business, then you will need to edit the noted Tax Profile Code and then select that tax in the Tax Group Details section. For more information, see Sage Knowledgebase article: How to update a Tax profile (Solution ID 225924650094925).

Note: If Yes appears in the Company Specific Rate column in the PR_TaxGroupDetail section, you'll need to update the tax group in Company Tax Group Setup as described below.

To update the tax group in Company Tax Group Setup

- On the Payroll Setup menu, click Company Tax Group Setup.

- On the Rates tab, select the applicable tax.

- Enter the effective date and tax rate.

- Click .

- Review the Payroll Tax Update Guide. This guide is intended to complement the information in the Payroll Tax Update Report. It's updated each time a tax update is made available, and it lists new taxes, withholding tax changes, and other related information.

- Run the Payroll Status Check utility, which is located on the Payroll Utilities menu. For more information, see Sage Knowledgebase article: How to troubleshoot payroll tax calculations (Solution ID 220924260101808).